do you pay sales tax on a used boat in florida

Florida boat dealers and brokers are required to collect tax from the purchaser at the time of sale or delivery. This figure includes all sales and use tax plus discretionary sales surtax.

How Much Is Sales Tax On A Boat In Florida

North Carolinas boat sales tax is 3 and capped at 1500.

. According to the Florida Department of Revenue a boat dealer is a person or business that sells boats offers or imports boats for retail sale in Florida. All boat sales and deliveries in this state are subject to Floridas 6 percent sales and use tax unless exempt. The absolute maximum tax you can pay on the sale of a boat or vessel in the state of Florida is 18000 as of 2018 state tax rates.

Floridas Sales Tax Applies to Boats. All boats sold delivered used or stored in Florida are subject to Floridas sales and use tax plus any applicable discretionary sales surtax unless exempt. Floridas 6 sales tax applies to all boats with a maximum tax of 18000 on the sale or use of any vessel.

Use tax is imposed at the same rate as a states sales tax but it is imposed on boats not taxed at the time of purchase. Florida boat dealers and brokers are required to collect tax from the purchaser at the time of sale or delivery. Sales and Use Tax All boats sold delivered used or stored in Florida are subject to Floridas sales and use tax plus any applicable discretionary sales surtax unless exempt.

Before you purchase a new or used vessel consult with your experienced Florida boat buying attorney we are ready to take your call. When you purchase a boat from a licensed dealer in Florida then the dealer is required to collect sales tax on the whole purchase price of all the tangible personal property being sold to you. 24 Pontoon Boat Rentals 2hr In 2021 Pontoon Boat Rentals Boat Rental Pontoon Boat.

The key to obtaining this benefit is the purchase MUST be through a Florida dealer and all the required paperwork must be. Boats Temporarily Docked in Florida When Florida sales or use tax has not been paid on a boat brought into Florida the boat is not subject to Florida use tax when the boat remains in a Florida registered facility that rents dockage or slippage for a period not to exceed a total of 20 days in any calendar year. However when you purchase a boat in Florida you need to be aware that there may be a sales tax liability upon return to your home state.

Sales tax is imposed at the time of purchase or transfer. Alabamas is 2 but has no cap. Sales Tax On A Boat Can You Avoid It.

If you anticipate taking your boat out of the country using it in a state that does not have a sales tax or actively cruising between lots of jurisdictions avoidance of paying the initial sales tax can be a big cost savings. Florida boat dealers and brokers are required to collect tax from the purchaser at the time of sale or delivery. Do you pay sales tax on a boat in Florida.

Use tax will probably be assessed when you register or document your boat in your home state. Portable Boat Ramps Pontoon Boat Accessories Pontoon Boat Covers Dog Boat Ramp Pin On Boats For Sale Fountain Powerboats By Fountain 42 Lightning Boat Cover 2007 2020 Enduracover Semi Custom 42 Performance Style Boat Cover Iboats Com Power Boats Boat Covers Speed. Sales and Use Tax All boats sold delivered used or stored in Florida are subject to Floridas sales and use tax plus any applicable discretionary sales surtax unless exempt.

This tax is called a use tax. To sum up the concepts you can expect to pay sales tax in its entirety when you purchase your boat from a licensed boat dealer like MacGregor Yachts and Evolution. So if you purchase a boat a motor a dozen life preservers a pair of paddles and other miscellaneous goods that go along with a boat the licensed dealer is statutorily.

In most cases Florida boat dealers and yacht brokers are required to collect sales tax from the buyer at the time of. Florida caps the amount of boat sales tax at 18000 no matter the purchase price. Discretionary sales surtax applies only to the first 5000 of the purchase price.

When it comes to flat rates the North Carolina sales tax on boats is 3 percent but capped at 1500 and in New Jersey its 33125 percent but in Florida its 6 percent and in Texas its 625 percent. Florida boat dealers and brokers are required to collect tax from the purchaser at the time of sale or delivery. Specifically if a nonresident purchaser comes to Florida buys a boat and fills out the correct paperwork the purchaser does not have to pay Florida sales tax on the boat.

All boats sold delivered used or stored in Florida are subject to Floridas sales and use tax plus any applicable discretionary sales surtax unless exempt. Similarly in Florida a non-resident need not pay tax if the boat is taken to a different state shortly after purchase. If you are looking into a superyacht purchase the cap for sales tax in Florida is 1800000.

How do you avoid sales tax on a boat in Florida. Generally Florida boat dealers and yacht brokers must collect sales tax from the purchaser at the time of sale or delivery. Florida Sales Tax And Outboard Engines Macgregor Yachts.

Varies between 7 to 9 on purchase depending on homeport plus personal property tax may also be due. The absolute maximum tax you can pay on the sale of a boat or vessel in the state of Florida is 18000 as of 2018 state tax rates. Florida Yacht Property Tax In 2021.

And on top of those rates your municipality or county may tack on another percent or two in local sales tax too. It can be paid at the time of registration in a state other than where a boat was purchased or it can be triggered by the use or storage of a boat for a certain amount of time in a given jurisdiction. Additionally certain Florida counties have a discretionary sales surtax.

Those prices range from 05-15 but cap at 5000. A few other popular boat-buying states taxes are. All boats sold andor delivered in this state are subject to Floridas 6 percent sales and use tax unless they are exempted from this requirement.

Do you pay sales tax on a used boat in florida Sunday March 20 2022 Edit. By law a licensed dealer must collect sales tax on the full purchase price of the vessel and they cannot split or remove itemized parts to adjust sales tax. However if you purchase a used boat from an individual even if on consignment through a dealer and the itemized invoiceBOS includes other items outboard trailer etc then the FL tax collectors agent will likely apply tax to the entire invoice which is incorrect.

Who is a boat dealer in the state of Florida. 2004 Grand Banks 46 Europa In Seattle Wa Grandbanksyachts Grandbanks Soldboats Trawlers Grand Banks Yachts Boat Boats For Sale.

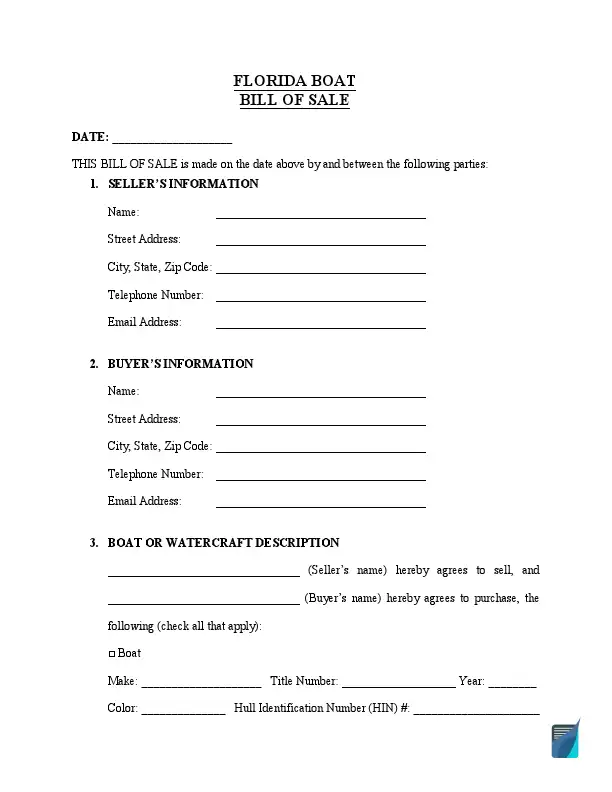

Free Florida Boat Bill Of Sale Form Pdf Formspal

Yatco Listing For Adventure Us Motor Yacht Boats Luxury Luxury Yachts

Pontoon Rental Pensacola Pontoon Boat Rentals Boat Rental Pensacola Beach

Boating Boom During Covid Biscayne Times

Florida Sales Tax And Outboard Engines Macgregor Yachts

How Much Is Sales Tax On A Boat In Florida

34 Regulator Center Console For Sale By Kusler Yachts New Boats For Sale Boat Power Boats Center Console Fishing Boats

Living On A Boat Full Time How Much Will It Cost You Boats Com

Do You Have To Pay Taxes If You Live On A Boat Yacht Management

Florida Boat Bill Of Sale The Hull Truth Boating And Fishing Forum

Boat Registration Guide Florida Boatsmart Blog

Fl Sales Tax Vs Dmv Boat With Outboard Motor

Brigitte Bardot S Riva Super Florida Woodenboatbuilding Boat Runabout Boat Classic Wooden Boats

Galati Yacht Sales Expands Operations To The West Coast Galati Yachts Boat Fishing Boats Sport Fishing

Tips To Registering A Boat In Florida

Yacht Photography Yacht Photographer Florida Offshore Fishing Boats Center Console Fishing Boats Boat

1947 Park Shipyard Trawler Yacht Power Boat For Sale Www Yachtworld Com Trawler Yacht Offshore Boats Yacht

Can Boat Buyers Avoid Paying Sales Tax Shore Magazine Boating Lake Of The Ozarks